The reawakened debate about a Swedish euro-adoption is rolling in 20-year old tracks. Few have yet noticed that the security of the EU and Sweden now necessitates an expansion whose success is entirely dependent on a strong European Central Bank. Sweden should preferably be part of influencing it, which may be reason enough to join the euro. Even the economic arguments for adopting the euro, however, have significantly strengthened according to an analysis that the Stockholm Free World Forum (Frivärld) will publish shortly.

Reforms for politicians who want to be reelected

A new book analyzes governments that completed their term of power in OECD countries between the mid-1990s and 2020. Governments that introduce ambitious growth oriented reforms not only boost entrepreneurship, job creation, human development and climate policy effectiveness, but also significantly increase their own chances of re-election.

This book updates and extends a previous book, Renaissance for Reforms, that has met wide international interest. It was reviewed in 37 different countries and translated into several languages.

Dr. Nigel Ashford, George Mason University, wrote:

“This is the required companion volume to Why Nations Fail by Acemoglu and Robinson. While those authors demonstrate that poor institutions are the explanation for economic failure, it is Sanandaji and Fölster that provide the the successful strategy to overcome the obstacles. They demonstrate that market reforms lead to both economic and electoral success. Policy makers no longer have an excuse for not following the best policies. Renaissance for Reforms is required reading for all interested in policy change: academics, students, policy makers and politicians.”

Order the previous book here http://www.adlibris.com/se/bok/renaissance-for-reforms-9789175669861

Sweden needs a smarter transport infrastructure

The Swedish transport infrastructure faces significant challenges. Transportations need to become emission-free as well as faster and more efficient. Unfortunately, the quality of the transportation system has deteriorated, contributing to the fact that Swedish industry, which is particularly dependent on transportation, now produces less than it did 15 years ago. A new report from the Entrepreneurship Forum shows that the struggling transportation system further challenges the already lagging competitiveness of Sweden. Facilitating smarter infrastructure solutions addresses many issues both in the short and long term.

From digital protectionism to digital alliance

The EU risks edging toward digital protectionism by means that according to most studies could undermine economic growth and security in Europe. In particular, digital protectionism jeopardizes Europe’s advantage in mainstream industries that rely on edge computing without increasing competitiveness in large scale digital platforms.

The EU and America share a legitimate need to secure supply chains and strive for technological leadership. These aims are weakened by indiscriminate trade impediments but would be strengthened by carefully crafted alliances.

A more ambitious operative atlantic initiative would be a “EUKUS”. A little noted second “pillar” of AUKUS, the defense deal between Australia, the US and the UK, entails collaboration on advanced technologies, such as artificial intelligence, quantum systems and hypersonic missiles. This second pillar could be a blueprint for an atlantic ”EUKUS.”

Urban Wealth Funds gaining traction

A series of opinion articles all over the US propose Urban Wealth Funds to improve governance of local government real estate and other assets, helping to stimulate housing and other infrastructure investments. One example is this article in the Columbia Daily Spectator on solving the New York housing crisis . Another example is this article by William Fisher on how Urban Wealth Funds could manage local Tech Gardens better.

Urban Wealth Funds were proposed by Dag Detter and Stefan Fölster, who together wrote the‘The Public Wealth of Nations’ (2015) which was listed as the book of the year by both The Economist and The Financial Times and the ‘Public Wealth of Cities’(2018).

Public wealth funds –

Supporting economic recovery and sustainable growth

A new report on Public wealth recommends funds as a tool to support the economy through Covid-19 today. The foreword by Martin Wolf of the FT is nothing but a wholehearted endorsement: “Public Wealth Funds are an idea whose time has come. This important study explains why this is so and how to create them successfully. It should not just be given close attention. Its ideas should be implemented, particularly by governments determined to “level up” regional inequalities and “build back better” after Covid-19.

The report is co-authored by Dag Detter, who led the restructuring of the Swedish government portfolio and advises governments worldwide on public wealth management and Stefan Fölster, who together wrote the‘The Public Wealth of Nations’ (2015) which was listed as the book of the year by both The Economist and The Financial Times and the ‘Public Wealth of Cities’(2018); the third author is Josh Ryan-Collins, Head of Macroeconomics at UCL IIPP and author of ‘Why can’t you afford a home?’ and Rethinking the Economics of Land and Housing.

The IMF was also interested and published our blog here.

Making real-estate assets work for local governments

In a new article in the Financial Times we show how local governments could avoid financial calamity by managing their assets professionally in an Urban Wealth Fund. This would benefit housing and mitigate segregation as well.

Read our article in the Financial Times, or here:

This is a guest post by Dag Detter, who led the restructuring of the Swedish portfolios of public assets, Stefan Fölster, President of the Swedish Reform Institute and Josh Ryan-Collins, a Senior Research Fellow at IIPP.

Continue reading “Making real-estate assets work for local governments”Who fought the pandemic best: governments or local authorities?

Two European countries who handled the covid-19 pandemic poorly entertain opposite ideas of the root cause. Many British public-health experts believe that the failures in response to the covid-19 pandemic have been the result not just of slow political decision-making, but also of the highly centralized nature of the British state.

In Sweden, with an exceptional number of covid-19 deaths per capita, the government as well as the doctor’s union claims that decentralization of health- and old age care is the main culprit.

Both have probably got it wrong.

Postcorona essentials: Reclaim public assets, boost growth and stave corruption

Economists have not concerned themselves much with good governance of public assets such as state owned firms or real estate. Yet world wide these assets are approaching a value of 150 trillion dollars or twice world GDP. Each percent better return generates about one and a half trillion dollars a year. Perhaps more significantly, better governance can improve the environmental footprint and lower legal and illegal corruption. Here is how to do it.

Sometimes fiction is the best guide to the future

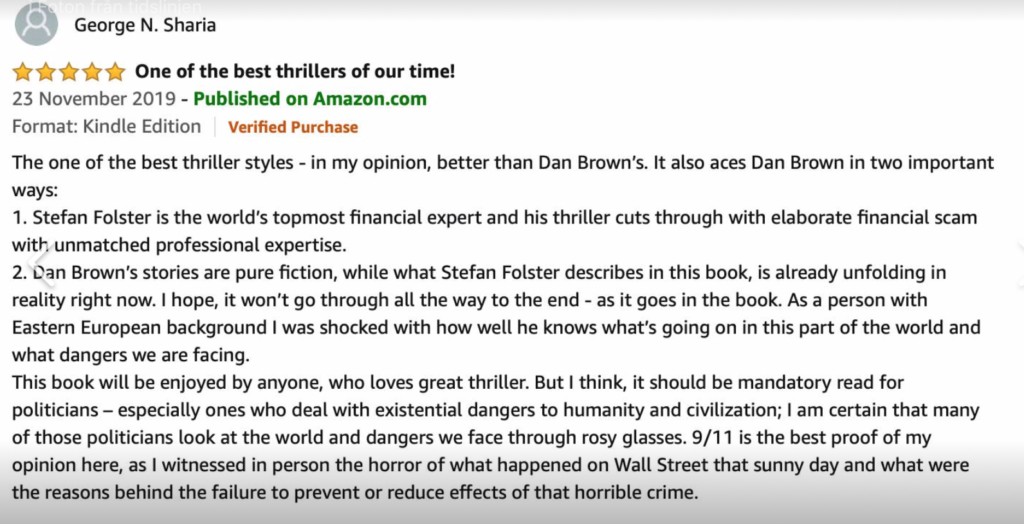

“The Crash of 2024” is not doomsday book. It weaves a plot based on real events and true crimes that are not yet in the news but are unfolding bit by bit. Here is one reader’s reaction: